Cite this as: Wood, J.R., Ponting, M. and Butcher, K. 2023 Mints not Mines: a macroscale investigation of Roman silver coinage, Internet Archaeology 61. https://doi.org/10.11141/ia.61.10

During the Second Punic War (218-201 BC), the silver denarius was introduced as a replacement for Rome's early currency silver systems (Crawford 1987, 43-51) and this became the backbone of Roman coinage for nearly 450 years (Elliot 2020, 68-85). The silver used for the Republican denarius was of a good standard of purity (often over 95% silver) and seems to have been maintained over time (Crawford 1974, 569). However, debased silver denarii became much more common in Imperial times from the reign of Nero (AD 54-68; Butcher and Ponting 2015). Nonetheless, the denarii continued to form the main silver currency of Rome even after a series of debasements in the 2nd and 3rd centuries AD, until it was replaced as the main silver coin by the antoninianus of Gordian III (AD 238-244).

Rome exploited metalliferous regions for precious metals (Wilson 2012, 133-55). Dacia, especially the large complex of gold and silver mines at Roșia Montană, was exploited soon after the conquest in AD 106 and probably throughout the 2nd and 3rd centuries (Hirt 2010, 41–44, 192–6). Upper Moesia (especially Kosovo, the Upper Timok valley and the Kosmaj region to the south of Belgrade) was exploited from perhaps as early as the 1st century AD and certainly in the 2nd to 4th centuries (Merkel 2007; Mladenović 2009, 70–81, 93–7). There were argentiferous lead mines in Britain and a lead-silver mine was in operation 100km east of the Rhine under Augustus, possibly before the Varian Disaster of AD 9 (Wilson 2012, 133-55) and the subsequent Roman withdrawal. For silver, however, the most important sources were in the south-west of the Iberian Peninsula: the Sierra Morena until the 1st century AD, and the south-western Iberian pyrites belt, such as Riotinto (Willies 1997) - the same region exploited successively by the Phoenicians and Carthaginians - with Tharsis, San Domingos and Aljustrel (Vipasca) being developed from the 1st century BC onwards (Domergue 1983; 1990; Hirt 2010, 260–69). In effect, the Roman state moved very swiftly to exploit metal resources in newly conquered or acquired territories.

Most Roman coins were minted in Rome (Cartwright 2018). The Roman mint was located on the Capitoline Hill, just beyond the western end of the forum near the treasury (aerarium). The mint of Rome had produced a large proportion of the denarii issued under the Republic, although during periods of conflict they had also been issued in the provinces by various rival powers. Under Augustus the Roman mint ceased issuing denarii, and from the 1st century BC to c. AD 64 the sole mint producing the denomination was Lugdunum (Lyon) in Gaul. The reasons for this remain obscure. The denarius mint was then returned to Rome (Butcher and Ponting 2015, 442). During the civil wars of AD 68-69, and during the reign of Vespasian (AD 69-79), supplementary mints for denarii operated in both the eastern and western provinces. The identity of these mints is not always certain. The use of travelling mints (Termeer 2015; Meadows 2020, 5), such as those used potentially by Antony to strike huge quantities of 'legionary' denarii in the lead-up to the battle of Actium (31 BC), further complicates the picture.

However, denarii were not the only kind of silver coinage produced in the late Republic and early Roman imperial period. Some of the provinces retained traditional Hellenistic denominations based on the Greek drachm and its multiples or fractions. While the denarius seems to have circulated quite widely in the Roman Empire, these 'provincial' silver coins tended to circulate in their respective provinces, without overlap (Butcher and Ponting 2015, 463). The monetary structure of the Roman world therefore consisted of a broader network of denarius use linked (in unclear ways) to regional networks involving the use of different provincial silver coinages.

Recently, archaeological science has studied silver coinage from a geological perspective, with a focus on provenance: the location of ancient argentiferous ore deposits that were exploited in the production of silver (e.g. Birch et al. 2020; Albarède et al. 2021; Milot et al. 2022; Vaxevanopoulos et al. 2022). It needs to be recognised, however, that any object that can be thrown back into a melting pot, including coinage, might have been recycled before it entered the archaeological record (Wood 2022).

The focus on provenance has obscured the importance of the chain of operation at each mint in shaping the compositional signature of the metal. Every mint is likely to have had its own, idiosyncratic, practices regarding the procurement and processing of silver. These processes might involve more than one episode of refining or alloying, even when it involved the use of freshly mined metal. For ancient coins the only evidence for these processes are the coins themselves, but we have plenty of comparative evidence for medieval and early modern practices. For example, at the medieval mint in Venice all silver for the coinage, including bullion and old coins, was first refined into ingots of standard fineness by cupellation, even if it was destined later to be alloyed with copper. The alloyed metal was then cast into new ingots in a secondary process, before being hammered into sheets from which the coins were cut (Stahl 2000, 321-38). The Tower mint in London in the 16th century AD assayed bullion and stockpiled it according to fineness until a sufficient quantity had accumulated, later adding silver or copper to the stock to make up the correct alloy for casting into ingots (Challis 1978, 10-11). Regular assaying of ingots and batches of coin (both before and after minting), intended to control standards, meant that a portion of the metal that entered the mint was recycled with added lead even before it left as coin (Johnson 1956, 84-85).

In effect, metals used for coins do not necessarily derive from one source and recycled metals and the melting down of existing coinage can result in mixed elemental and isotope analytical signatures. Furthermore, silver refined using lead (cupellation) to increase silver purity, and silver coinage debased with copper not only remove impurities from silver, such as easily oxidised base metals (e.g. lead, copper etc.) that subsequently partition into production debris (e.g. litharge, PbO), but also introduce lead and copper (and any impurities associated with these metals), above that already present, into the silver. Since lead used for refining silver does not necessarily derive from the same location as the source of the silver, the lead isotopic analytical (LIA) signature is likely to reflect where the lead was acquired rather than the source of silver (Wood et al. 2021).

Silver isotopes have been proposed as possible geochemical tracers of silver for silver coinage (e.g. Desaulty et al. 2011; Albarède et al. 2016), to circumvent the problems associated with lead isotopes. Unfortunately, Ag isotopic variation appears to be controlled by ore genesis rather than geology (Arribas et al. 2020), making them of marginal interest for provenance studies (Milot et al. 2022). Despite this limitation, some research groups have continued to pursue silver isotopes for provenance investigations (Albarède et al. 2021; Milot et al. 2022; Eshel et al. 2022; Vaxevanopoulos et al. 2022). Galena ores from Iberia, for example, have been proposed by Milot et al. (2022) as the source of silver for Roman denarii of different origins and ages of minting, based on the narrow range of Ɛ109Ag (that is, the deviation per 10,000 of silver isotopes of a given sample relative to the US National Institute of Standards and Technology [NIST] 978a Ag standard), compared to the wider range of Ɛ109Ag in silver-bearing base metal (Pb, Zn and Cu) ores. Concentrations of antimony, bismuth and arsenic in the silver coins, which have been attributed to pre-existing galena acting as a trap for fluids containing these elements in argentiferous ores (Milot et al. 2022), have been considered to further support this provenance.

Despite application of two types of data (isotopic and elemental) to provenance silver sources, this geological mechanism perhaps becomes moot when archaeological/historical evidence and recycling is taken into consideration.

First, although it is well known that Iberia was a major source of silver for the Phoenicians, Carthaginians and Romans, silver was derived from deposits of silver-bearing jarosite ore (especially around the mining region of Riotinto in south-west Iberia) rather than solely argentiferous lead ores, such as galena (e.g., Rothenberg and Blanco-Freijeiro 1981; Willies 1997; Hunt Ortiz 2003; Anguilano et al. 2009; Murillo-Barroso et al. 2015; Wood and Montero-Ruiz 2019). Roman lead ingots stamped with the Cartagena mark (Salkield 1982, 137-47; 1987, 15), some 400km away in south-east Iberia, recovered at Riotinto, and production slag (Anguilano 2012) exhibiting the influence of a Cartagena LIA signature, both support the view that lead was added to these lead-poor jarosite ores to extract silver, thereby giving the refined silver the lead isotope signature of the lead added.

Second, silver was often debased with copper to make coinage (Butcher and Ponting 2015). This debasement process could conceivably have introduced antimony and arsenic into the silver if the copper derived from fahlore (that is, a solid solution of tetrahedrite Cu12Sb4S13 and tennantite Cu12As4S13 – Pernicka et al. 2016). Moreover, significant concentrations of bismuth in silver coinage are perhaps better explained by recognising that the lead used in the cupellation process to refine silver can contain bismuth (L'Héritier et al. 2015).

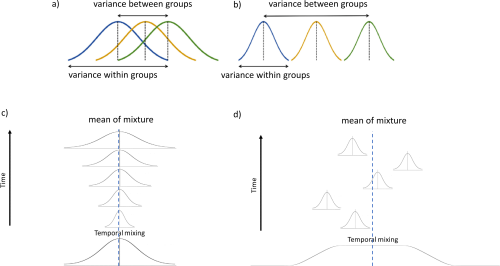

Third, and perhaps most significant, silver coinage could be recalled, reminted, and reissued. This seems to have been the normal practice of the Rome mint from Nero to Trajan (from c. AD 64-104) (Butcher and Ponting 2015). Mixing of silver and/or silver coinage would have affected elemental and isotopic signatures. Figure 1 presents changes associated with mixing for any continuous variable (Perreault 2019), and highlights that the provenance postulate (Figures 1a and 1b) can be affected by mixing (that is, provenancing is possible as long as a difference exists between sources that exceeds variation within each source). Figure 1c shows that if silver and/or silver coins all derived from one silver source and that this silver was smelted and refined using the same raw materials over time, the mean would remain relatively constant after recycling, even if differences in processing (e.g. between batches) caused fluctuations in the variance of the distributions. In fact, a stable mean but changing variance would result in a time-averaged distribution in which the central values are overrepresented. However, if silver coins from different origins were mixed together (perhaps during reminting and/or debasement), the mean values of the coins could fluctuate over time and the variance in the time-average assemblage would be much larger than it ever was at any single point in time (Figure 1d): that is to say, even for a constant variance, the distribution of the mixture would be wider, flatter, and converging to a uniform distribution. The mean of this mixture would lie between the means of the individual batches.

Essentially, recycling can explain the narrow range of silver isotope values with respect to the standard (that is, Ɛ109Ag) not only for Roman coins (Milot et al. 2022), but also for Hellenistic, medieval, modern silver coins and hacksilver (Desaulty et al. 2011; 2013; Albarède et al. 2016; 2021; Milot et al. 2021; 2022; Eshel et al. 2022; Vaxevanopoulos et al. 2022), which all report Ɛ109Ag values that have narrower ranges than those reported for hypogene and supergene ores (Mathur et al. 2018; Arribas et al. 2020). This would cast doubt on the regions in Iberia identified for the provenance of the silver used for Roman coinage (Milot et al. 2022), or at least the procedure used to arrive at this provenance.

To some extent, the arguments raised here against the application of silver isotopes when recycling is involved are similar to those levelled against lead isotopes over 40 years ago (e.g. Jessop-Price 1980, 50-54; Gale et al. 1984, 394). In effect, the actions of smelting, refining and recycling silver and/or silver coins, as well as debasement of silver coinage with copper (and potentially with brass and bronze coins), would alter the elemental and isotopic signatures from that associated with the geological source of silver, making provenance of the silver source potentially intractable.

We therefore put forward the suggestion that compositional and isotopic analyses on Roman silver coins are better placed to identify groups associated with historical and archaeological markers, such as mints and currency reforms, rather than attempting to decipher the signatures to directly provenance the silver in these coin cocktails. In effect, we propose that geological studies should support, rather than drive, archaeological investigations to better understand the anthropogenic signatures associated with the processes of mixing, debasement and recycling carried out at mints, to inform on the societies, economies and political contexts where coins were circulated.

The approach taken in this article is to analyse elemental and lead isotope measurements of silver coins from the early Imperial Roman period. The compositional data examined here span the period from the early 1st century BC to AD 100 and are from the project that led to the publication of The Metallurgy of Roman Silver Coinage (Butcher and Ponting 2015) and are freely available on the Archaeology Data Service (ADS) (Ponting and Butcher 2015).

There are two datasets associated with this project: the Denarii dataset has 728 denarii and the Provincial dataset has 348 coins of other types, such as tetradrachms. The denarius dataset comprises 'legionary' denarii of Mark Antony and then coins from late in the reign of Augustus through to early in the reign of Trajan. The Provincial dataset covers a slightly longer chronological span by including Antioch tetradrachms issued from 57 BC. There are also some chronological outliers in the Provincial dataset, namely those coins attributed to the late Hellenistic Seleucid king Philip I Philadelphus, who reigned from c. 94–83 BC and the so-called 'Posthumous Philips' (Antiochene coins struck with a likeness of Philip minted in the late Republican period). Otherwise, the Provincial dataset covers roughly the same span of time as the denarii. Essentially, the Provincial dataset includes both Roman Provincial coins and coins struck at the same period in independent (or perhaps client) states, such as Cleopatra VII of Egypt or the kings of Mauretania.

Each coin was recorded with a sample reference number (e.g. BCC10), a type (a numismatic description of the obverse and reverse), and - if known - the mint, the name of emperor/ruler under whom the coin was struck (if relevant) and the name of the person in whose name the coin was struck. In a number of cases it should be understood that the identity of the mint is provisional; the coins themselves rarely bear any explicit mint marks and attribution to a mint often relies on stylistic features and/or circulation patterns (now supported by compositional data). There is also information on any hoards from which the relevant coins come, donors who provided coins to museums, and weights of each coin, where available.

The current article uses the data as recorded in the digital archive (Ponting and Butcher 2015). However, it needs to be highlighted that certain terms on the database were introduced for convenience when the database was first set up. For example, the column under the heading Emperor also includes coins minted for people who were not emperors (such as Antony), and Civil War coins are anonymous. Furthermore, the term 'Hellenistic' in the Emperor column refers solely to those coins minted at Tyre (as noted in the Mint column), and 'Cleopatra' on the database refers to the Ptolemaic queen Cleopatra VII, unless associated with Mauretania and Juba II when it refers to Cleopatra Selene. The term Donor on the database is shorthand for the name of the collection that provided access to the coins.

No data have been removed unless there were comments on the database regarding their attribution. For example, coins without a secure attribution (e.g. 'O' mint) and those highlighted in the comments section on the database as possible forgeries (e.g. silver-plated forgeries, such as BM008) have not been included. Details of the excluded coins are listed below in the lead isotope and elemental data preparation sections. There are a few coins on the database with compositions that suggest copies. For instance, BM024 (minted at Gaul under Galba) has a silver concentration of around 10%, much lower than other coins minted under this emperor. However, these coins have been included as it was the elemental composition (that is, the focus of the article) that highlighted these coins as potential contemporary forgeries. It should also be noted that certain attributions and categorisation are presented as they were first denoted and could perhaps be combined. For example, Juba II and Juba and Cleopatra (Mauretania) are recorded separately on the database but could be placed in one group. Nonetheless, the statistical approach taken in the current article focuses on the patterns that emerge from the elemental analyses of over 1000 coins. In effect, the current article accepts the database as is, with the aim to identify patterns in the elemental and lead isotope data that allow researchers focusing on smaller sets of coins to make interpretations.

Further details on emperors/rulers, dating and the particulars of individual coins, can be found by referring to the archive (Ponting and Butcher 2015) and the publication The Metallurgy of Roman Silver Coinage (Butcher and Ponting 2015). These resources are particular useful for situating coins within their geographical and chronological frames.

The procedure adopted in the current article aims to investigate this compositional data by:

We appreciate that this approach is a 'broad brush'. However, we believe that details on how individual and/or specific groups of coins fit into these analyses and whether they may or may not support socio-historical narratives are best approached by appreciating the variation in the datasets to allow meaningful comparisons and interpretations.

Of the 1076 coins in the two datasets, 114 denarii and 56 provincial coins have lead isotope data. This section analyses the LIA data.

Coins associated with LIA values are attributed to the following mints:

Denarii dataset: Antioch, Antony, Ephesus, Gaul, Lyon, O mint, Rome, Spanish, Unknown Group 3 (UG3)

Provincial dataset: Antioch, Caesarea, Cyprus, Ephesus, Judaea, Lycia, Pergamon/Ephesus?, Seleucia, Syria, Tarsus, Tyre

The Denarii and Provincial datasets were combined and mints were divided into three categories based on the geographical location of the mints: East, Rome and West. Two coins from UG3 and two coins from O mint (named after the 'O' inscriptions) were removed at this stage because these coins are not attributed securely to specific mints. Furthermore, the coins of Antony (11 legionary denarii, possibly derived from travelling mints) and one cistophorus (minted at either Pergamon or Ephesus) have been placed in the East dataset group because of the geographical location of Antony's campaign leading up to the battle of Actium (31 BC).

The three groups are (numbers of coins in parentheses):

East dataset: Antioch (36), Antony (3), Caesarea (7), Cyprus (3), Ephesus (15), Judaea (2), Lycia (1), Pergamon/Ephesus (1), Seleucia (1), Syria (1), Tarsus (1), Tyre (3)

Rome dataset: Rome (54)

West dataset: Gaul (15), Lyon (12), Spanish (11)

(Note: coins attributed to Gaul are any Gallic coins not attributed to the mint at Lyon.)

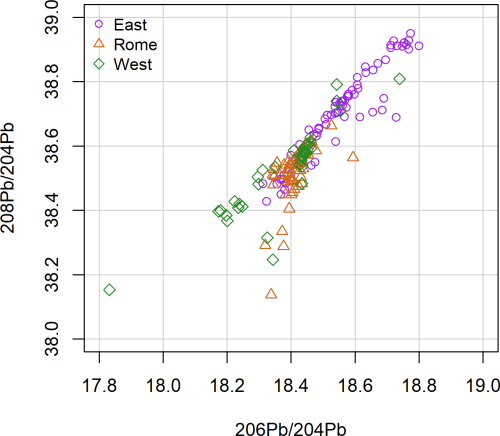

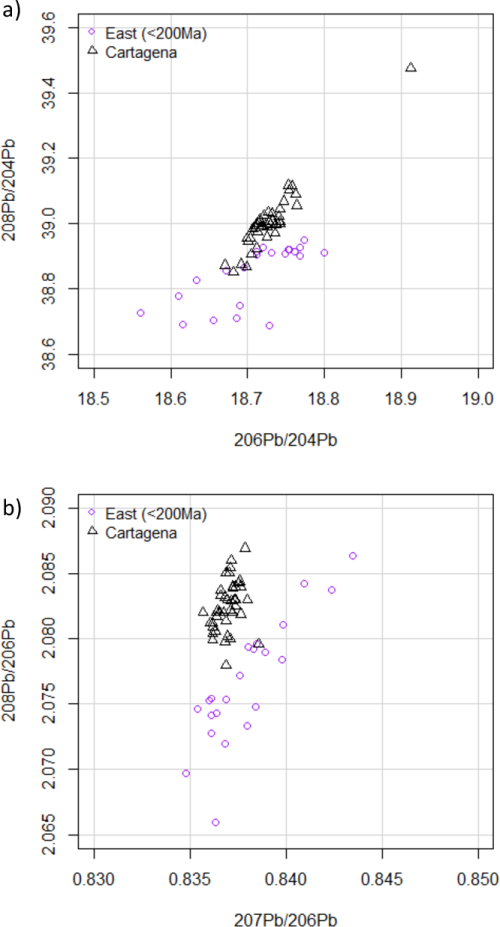

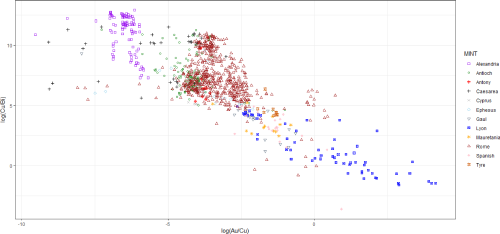

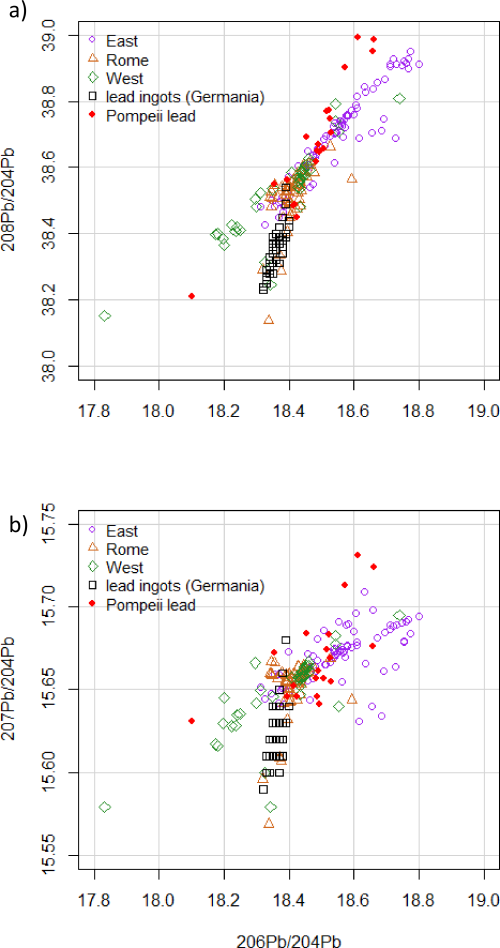

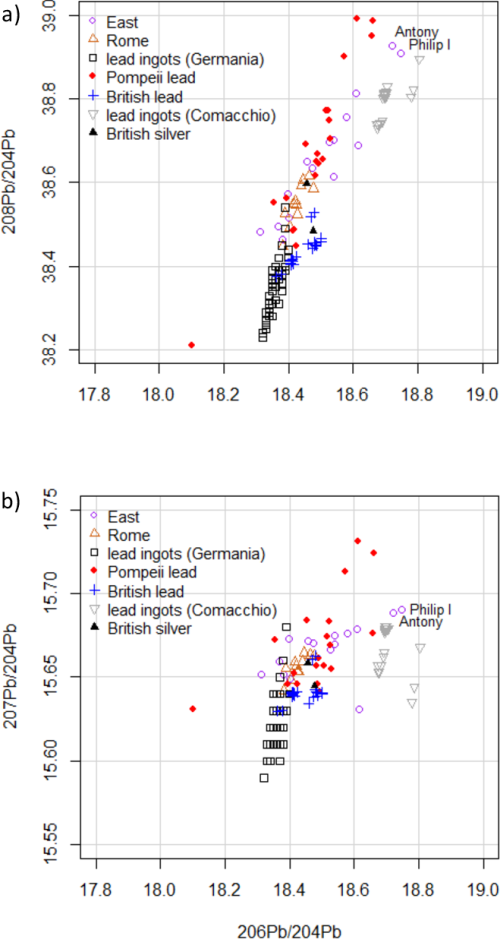

Figure 2 is a traditional LIA plot for these three groups of coins, clearly highlighting the wide spread in values of the East, Rome and West data. A branch consisting of seven coins appears to lie below the other data, with four coins minted at Rome under Nero, one minted under Otho at Rome, one minted under Tiberius at Lyon and one minted under Augustus at Lyon. The confluence of overlapping coins from the East, Rome and West mints suggests that mixtures of silver and/or lead and/or coins are prevalent in Roman silver coinage.

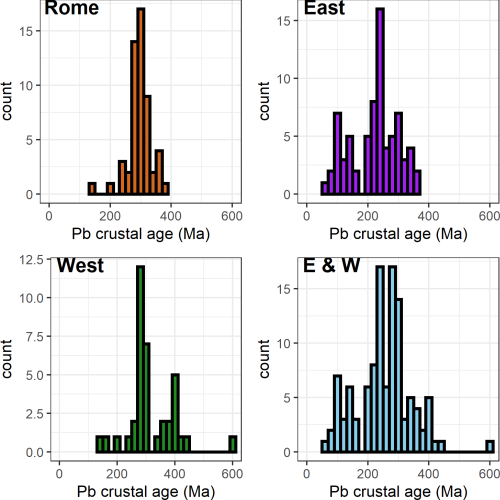

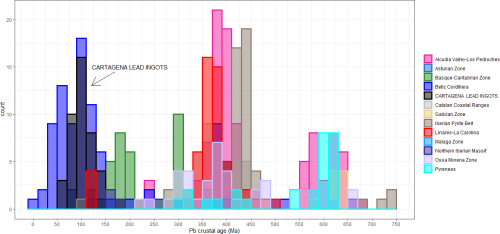

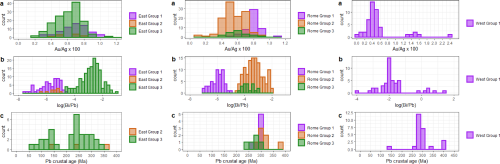

Figure 3 presents histograms of the same LIA data converted to a Pb crustal age, also known as a model age, measured in millions of years (Ma), using the parameters of Albarède and colleagues (e.g. Desaulty et al. 2011; Albarède et al. 2012). The positive ages suggest that the lead associated with the coins came from what is often referred to as common lead; that is, the data can generally be described by isotope evolutionary models to determine a geological age. Furthermore, the histograms indicate that the coins minted in the East potentially are of at least two types (as indicated by the emerging bimodal signature): one type with lower ages (i.e. age <200Ma) than the other (i.e. ages lie between 200Ma and 400Ma). Similarly, the coins minted in the western mints also appear to form two groups with ages centred around 300Ma and 400Ma, which are consistent with the model ages found in Iberian galena ores, which exhibit peaks around 94±38 Ma, 201±39 Ma, 296±6 Ma, 392±39 Ma and 614±41 Ma (Milot et al. 2021, fig. 5). Coins of the Roman mints could be mixtures of metals used to mint Western and Eastern coins, and/or Rome may have its own separate unique signature.

Compositional data are also available for the coins. Details of the ICP-AES and AAS experimental procedures used to measure the compositional data are available in The Metallurgy of Roman Silver Coinage (Butcher and Ponting 2015). Fourteen elements had been measured and presented in weight %: As, Au, Cu, Fe, Ni, Pb, Sb, Sn, Zn, Mn, Cr, Co, Bi and Ag.

Samples for elemental analysis had been taken using steel twist drills (with the turnings being collected after discarding the first millimetre or so to avoid using the altered surface material). Fe, Ni, Mn, Co and Cr were removed from the subsequent analyses to reduce any influence of possible contamination from this procedure (Wood and Liu 2023). This left nine elemental components: As, Au, Cu, Pb, Sb, Sn, Zn, Bi and Ag.

Some coins were removed from the combined Denarii and Provincial datasets. As with the lead isotope analyses, coins not secured to a mint were removed: UG3 (4), UG5 (1), O-mint (4). Coins that were found to be silver-plated or probable forgeries (Cat. nos BM008, BM010, BM022, BM026) and coins without a mint being catalogued on the database (Cat. nos W88 and Y72) were also removed. Eight coins were removed because the elemental compositions contained zeroes in one or more of the component values (Cat. nos WM190, H2, CE2, CE3 and KB40-KB43). One coin attributed to Tarraco in the mint column of the dataset was reassigned to Spanish. From the initial 1076 coins, 1053 remained for the analyses.

A cursory examination of the denominations of the 1053 coins in the datasets (i.e. Denarii and Provincial - Ponting and Butcher 2015) shows that the denarii (714 coins) have silver contents with mean and median values of around 85%Ag and a coefficient of variation (CV) of around 10%. The 339 coins in the Provincial dataset (drachms, didrachms, tetradrachms etc.) have mean and median values of 55%Ag and 65%Ag, respectively, and a CV of 47%. The 259 tetradrachms have a mean of around 50%Ag. In effect, the denarii have generally higher silver concentrations and lower variation than the coins in the Provincial dataset, with much of the variation in both groups attributable to the addition of copper, debasing the coinage.

Descriptive statistics can be somewhat deceptive because the concentrations of silver among the coins are not necessarily distributed normally. This is evident in the histograms (Figure 4) for the silver concentrations of coins delineated by emperor. For instance, there are three probable groups for the 38 coins associated with the Emperor Claudius (Figure 4): coins with high purity minted in the West, and debased and heavily debased coinage minted in the East.

This East-West divide is apparent for coins from other emperors. All coins minted in the west have high levels of silver, with eastern mints producing coins with lower silver concentrations and the coins from the Roman mints lying between them. The only exception to this pattern is that of the relatively early (compared to the other coins in this dataset) Hellenistic coins minted at Tyre (from the East), which have high silver contents.

Figure 4 hints at the possibility that high-purity silver bullion derived from the West (with some of it minted into high-purity silver coins), before travelling east to Rome and beyond where copper was added. In fact, Figure 4 could be interpreted as reflecting the movement of silver from the West to supply the mints of the Roman Empire; that is, silver refining was conducted in the West and high-purity silver ingots were transported eastwards.

From an analytical perspective this view is attractive, as it implies that the chemical and isotopic signatures of refined silver ingots would be preserved until they reached their destination mints, prior to the subsequent addition of copper to produce coinage of the required fineness. Furthermore, this scenario would delimit compositional variation in the base composition (i.e. prior to the addition of copper during debasement) to one geographical region; that is, the West. Presumably, processing variability, such as the number of times a lead-silver ingot underwent cupellation, would also be lower if one region was in control of refining, thereby potentially further reducing variation in the compositional signatures. In effect, this scenario would allow variation in the coin datasets, as exemplified in Figure 2, Figure 3 and Figure 4, to be attributed to compositional variation that occurred after silver was refined in the West, that is, to the addition of copper at each mint and to any subsequent recycling to make new coins.

However, archaeological evidence suggests that silver might have been transported as semi-refined ingots rather than as silver ingots of high purity, thereby requiring further refining at the mints. Evidence of these semi-refined ingots can be found in Iberia from the times of the first ventures across the Mediterranean from the East. For instance, silver ingots from Iberia's 'Orientalising period' (8th-6th centuries BCE) generally have very high levels of lead (Murillo-Barroso 2013, 225-26; Hunt Ortiz 2003, 208; Renzi et al. 2007, 5). For example, a Phoenician ingot from the early 1st millennium site of La Rebanadilla in south-east Iberia has the following composition: 79%Ag, 16%Pb, 3-4%Bi, 1.35%Cu, 0.12%Au and other minor elements (Wood and Montero-Ruiz 2019). The high levels of bismuth and gold, along with its Hercynian (rather than Alpine) crustal age determined from LIA, suggest that this silver ingot derived from Riotinto in south-west Iberia and that it travelled to La Rebanadilla for shipment. In effect, the composition of the La Rebanadilla ingot suggests that the silver transported out of Iberia was in the form of coarse silver-lead 'cakes' (along with their associated intrinsic impurities) and that it was only at their destination that ingots were purified through further cupellation and deliberately alloyed with copper; that is, silver underwent a primary cupellation, probably in a simple scorifier at the smelting site, before being made into an ingot and transported to mints.

The most direct evidence of metals moving in the form of ingots is from shipwrecks. Ingots of lead, copper alloy, iron, and tin have been found in Roman wrecks, but none of silver or gold (Wilson 2012, 133-55). Since many of the copper and lead ingots come from mines in Spain that also produced silver, the implication is that the lead and silver ingots were shipped separately from each other, with gold and silver ingots perhaps being transported overland under military escort to avoid the risk of shipwreck (Wilson 2012, 135). Although Roman silver ingots may have been of higher purity than the ingots of Iberia's Orientalising period, it could be argued that the main role of silversmiths at the destination Roman mints was not only to add copper to attain the required fineness of the minted coins but to also monitor and refine the incoming procured ingots; that is, large-scale silver extraction usually requires multi-stage cupellation (see Percy 1870; Sisco and Smith 1951). This suggests a two-fold problem regarding lead: first, lead added at the smelting site does not necessarily derive from the same geological location as the silver-bearing ores; second, the lead used by silversmiths at the mint during the refining process does not necessarily derive from the same lead deposits as the lead used during smelting. This scenario clearly places limits on geology-driven research that aims to provenance silver used for coinage to the silver ore source using lead isotope analyses. This would suggest that regardless of the mathematical procedures used to delineate the lead isotope signatures of ore sources into well-defined zones (e.g. wrapping ellipses, kernel density estimates, convex hulls etc.) (Wood 2023), it is probable that even unique ore signatures would be difficult to attribute to the silver source of Roman silver coins, and vice versa.

Nevertheless, despite contamination with exogenous lead affecting the LIA signatures, there are compositional indictors that can be used to investigate stages in the coin production process: the gold-to-silver ratio, and the concentrations of bismuth associated with lead in silver.

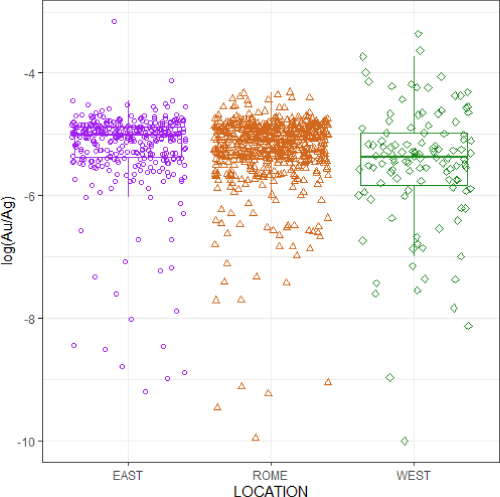

Gold is an indicator that has been used to provenance silver from ore to object because of its chemical inertness; that is, it is likely that gold remains at the same levels through the smelting and cupellation processes on forming a solid solution with silver (for a practical application, see Wood et al. 2019). By this rationale, variation in the concentrations of gold in silver should reflect variations in the silver sources exploited. Figure 5 plots the gold-to-silver ratio (values logged for clarity) for the coins minted in the three nominal geographical regions. The high gold-to-silver ratios support the view that the majority of silver coins in these datasets derived from the ores that had high levels of gold (average 0.5% Au).

The high gold levels in these Roman silver coins largely rules out argentiferous lead ores (such as galena) as a primary silver source, as lead ores have gold-to-silver ratios that are generally lower by two orders of magnitude (Gale et al. 1980; Meyers 2003, 271–88; Wood et al. 2021). A more probable ore source, both compositionally and archaeologically, is jarosite, such as the jarosite ores of Riotinto in south-west Iberia, an area attested archaeologically to have been exploited by the Phoenicians, Carthaginians and the Romans (e.g. Domergue 1990; Willies 1997; Salkield 1982; 1987; Rothenberg and Blanco-Freijeiro 1981; Anguilano et al. 2009; Anguilano 2012). The ores of Riotinto have gold levels that range from 0.3-16Au% (Gale et al. 1980, table 1). Furthermore, 'Orientalising' (8th-6th centuries BCE) silver objects from Iberia have gold concentrations that range between trace levels and 6.4%Au (Montero-Ruiz et al. 2008; Wood et al. 2019), and silver recovered from the probable Roman production site of Las Arenillas (site RT103: also known as Cerro del Moro, a prominent steep hill next to the small mining town of Nerva, about 3km from the main slag heaps of the Riotinto mine – Craddock et al. 1987) has a gold concentration of 1.37% (that is, log(Au/Ag) ≈ -4) (Wood 2019 : table 8.3; Wood and Montero-Ruiz 2019). In effect, the coins in the three geographical groups (Figure 5) have Au/Ag ratios consistent with mineral sources with high gold-to-silver ratios, which, at least for the coins in the West group, could implicate the jarosite ores of south-west Iberia. However, it must be noted that this provenance is based on one indicator and there may be other silver sources with similar Au/Ag ratios. Furthermore, the range of Au/Ag ratios of silver objects, production debris and ores in Iberia is wide, which makes this indicator difficult to apply with certainty.

It is here that silver isotopes could have benefited provenance investigations. However, as already mentioned, isotopic variation of Ag in ores from Ag deposits of different styles and ages indicates that the use of Ag isotopes as a geochemical tracer is complicated because of the minor variations in hypogene minerals (Arribas et al. 2020; Milot et al. 2022), thereby making geographical differentiation between deposits problematic. Moreover, differences of ε109Ag in As‐rich sulfosalts and supergene mineral products would be potentially masked when copper is added to silver, as copper will introduce its own impurities (including arsenic). Nonetheless, the repercussions of the high Au/Ag ratios are significant: if the silver did not derive from an argentiferous lead ore, it is probable that lead would need to be added to collect the silver during smelting (as well as being added during refining at the mints), which would dominate the LIA signal.

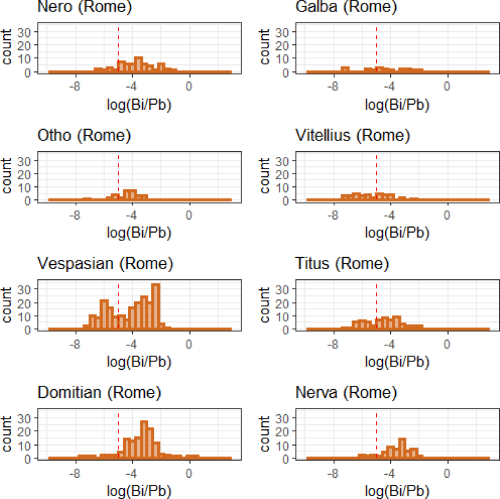

Another compositional indictor that may identify steps in the coin production process is bismuth. Bismuth (which potentially derives from both lead and silver) is unlikely to be completely removed from the smelted silver used to make the ingot during the refining process, as it oxidises only at the end of the cupellation, with the amount of bismuth remaining in the silver depending on how well cupellation is conducted rather than on the initial bismuth concentration of the lead bullion (Pernicka and Bachmann 1983; L'Héritier et al. 2015); that is, large-scale production of semi-refined silver is likely to retain bismuth (assuming that bismuth was present in the first place), while cupellation of semi-refined silver ingots aiming for high purity silver is likely to have lower amounts of bismuth. As L'Héritier et al. (2015) point out, the problem for coinage is that although bismuth can be considered as an ore source tracer for silver (using the Bi/Pb ratio) in silver production contexts, the addition of further lead or copper will erase this signature. This observation could suggest that bismuth remaining in silver coinage is from lead added during refining, and that log(Bi/Pb) reflects the origin of the lead added at mints.

The dilution of the smelting signature seems to be supported by Figure 6, which shows that the log(Bi/Pb) ratio is higher for the coins from the West mints than those from the East and Rome; that is, lead used to refine silver in Iberia had higher levels of bismuth. In fact, these high values are consistent with the high bismuth levels found in lead ores in Iberia, as well as in Iberian silver (high levels of bismuth are found in bismuth-rich ores at Riotinto: trace - 0.25% Bi, in refined silver found on the slag heaps of Riotinto (0.42% Bi) (Salkield 1982, 137-47), the semi-refined silver ingot from La Rebanadilla (3-4% Bi) and silver from Las Arenillas (15.4% Bi from Craddock et al. (1987); and around 22% Bi from EPMA measurements from Wood and Montero-Ruiz (2019)). Litharge at Corta Largo (Anguilano 2012) has bismuth levels ranging from hundreds to thousands of ppm, which is commensurate with other Spanish litharge (Walton and Trentleman 2009).

In effect, the assumption made here is that concentrations of bismuth in silver coinage derive predominantly from the lead used to refine the silver and not from smelting. Furthermore, although it is appreciated that bismuth concentrations can vary with the proficiencies of silversmiths conducting cupellation, the logratio of (Bi/Pb) reflects the origin of the lead added (which may be a mixture of various lead sources but also, in some cases, could relate to lead smelted directly from a single lead deposit). In other words, the higher mean and median values of log(Bi/Pb) for the silver coins minted in the West (Figure 6) indicate a different lead supply was used during refining at the West mints compared to the lead added at the mints in the East and at Rome.

Evidence of the LIA signal being dominated by lead used during refining is supported by the archaeological record. The aforementioned lead ingots recovered at Riotinto stamped with the Cartagena mark and production slag exhibiting a potential influence of a Cartagena LIA signature unsurprisingly have LIA signatures that match with lead ores found in south-east Iberia (Figure 7), near Cartagena. However, the same signature is not present in the silver coins under investigation here; that is, there is no peak in the crustal ages of coins from the West at around 100Ma (Figure 3). This indicates that although lead from Cartagena was used to smelt jarosite ores to produce argentiferous lead metal, the silver produced was either not used for coinage or the silversmiths at the mints in the West used lead from other regions to refine silver; that is, lead from ore sources (probably in Iberia) with higher crustal ages (around 300Ma and 400Ma, Figure 3), such as those from the Alcudia Valley-Los Pedroches, the Iberian pyrite belt and Linares-La Carolina (Figure 7). The massive exploitation of the Riotinto region for silver by the Romans and the plentiful supply of galena ores in Iberia, suggest that the latter scenario is more probable; that is, lead ores with higher crustal ages, probably located closer to the mints, were used in the West to refine ingots to make Roman silver coins, and this refining lead overwrites the signal associated with the lead used during smelting.

This raises the issue of the low crustal age coins minted in the East (i.e. coins with crustal ages <200Ma) in Figure 3. Figure 8 presents traditional LIA plots for the Eastern coins with low crustal ages (i.e. <200Ma in Figure 3) and for the Cartagena lead ingots. Both plots indicate that the LIA signatures of low crustal age ores of the coins minted in the East are not consistent with those of the Cartagena lead ingots. In effect, the absence of a LIA signature associated with low crustal age ores largely rules out the ores of south-east Iberia (94Ma±38Ma, Milot et al. 2021) as the source of lead used to refine silver for Roman coinage in these datasets. This is not particularly controversial as lead ores are relatively ubiquitous (as are lead objects), with silversmiths potentially using the most readily accessible lead in the refining process. Nonetheless, this does not rule out other lead ores from Iberia being used at mints in the East and at Rome, as well as the West, to refine silver; that is, lead ores in Figure 7 with similar crustal ages to those in Figure 3 were transported in the form of ingots (such as those lead ingots discovered in shipwrecks found off the coast of Iberia).

Figure 8 also highlights that lead from a geologically young deposit was available to refine silver for coins in the East (Figure 3). The coins with low crustal ages (mean Pb crustal age = 122Ma) in Figure 8 were minted under: Philip (2), Posthumous Philip (3), Hellenistic (2), Antony (4), Augustus (2), Nero (2), Vespasian (3), Domitian (4). As the majority of these coins are chronologically early in the dataset under investigation, this suggests that this geologically young lead source derived from a lead deposit, presumably in the East, that was available at least as early as the time of the Hellenistic Seleucid monarch Philip I Philadelphus (c. 94–83 BC). Furthermore, as this lead source is evident in later coins, such as those minted under Antony, it would suggest that these same lead sources (and/or lead objects from these sources) continued to be exploited, and/or that coins were recycled and reminted from silver coins such as those minted under Philip.

The provenance of silver and lead sources would clearly benefit historical and archaeological research. However, methods that suggest geological provenance based on matching signatures are only useful if they are supported by archaeological and historical evidence. In effect, it is not sufficient to assume that because a geological source exists (or is assumed to have existed) that it can be used to support sociocultural narratives without historical or archaeological evidence for the exploitation of that source. Furthermore, there are benefits in knowing when a source became available and where it was used without necessarily knowing its precise geological provenance. The approach taken here is to treat the elemental and LIA data as potential identifiers of actions conducted at mints to better inform on the societies, economies and political contexts where coins were circulated.

The analyses were conducted in R (R Core Team 2020) using the easyCODA package for logratio analysis (Greenacre 2018). Logratio analysis (LRA) was used to interrogate the elemental data (Aitchison 1986; 2005; Aitchison and Greenacre 2002; Baxter 1989; Buxeda i Garrigós 1999; 2008; Pawlowsky-Glahn and Buccianti 2011; Greenacre 2018; 2021). The LRA approach treats the system as a series of subcompositional components, or parts, realising that the elements being analysed are a subset of a potentially larger dataset, which affects their percentage values. The main idea is to analyse element ratios that are unchanged whether observed in subcompositions or extended compositions, and to logarithmically transform the ratios to put them on an additive (interval) scale. This method was first proposed by Aitchison (1986), who defined a relative geometry where only the pairwise logratios of the different components were considered (see Aitchison 2005). The motivation for an archaeologist to use a method based on ratios of components is that this makes compositional data, and thus, the results of statistical analysis, invariant to the particular choice of components (Chayes 1949). In effect, removal or inclusion of elements, perhaps because of the application of different instruments by different research groups, will affect the absolute percentages when closed to 1 (or 100%), but the ratios between components remain unchanged.

The procedure adopted here also makes use of bootstrapping methods in order to determine univariate or multivariate confidence limits (Greenacre 2016). Bootstrapping involves taking a large number (in this application, 1000) of samples of the original sample, with replacement, computing the group means of each one, giving an approximate empirical distribution of the mean. In multivariate space, bootstrapping allows the computation of a region enclosing a multivariate mean with prescribed confidence, usually 95%. In effect, these confidence ellipses show the variability in the mean rather than the variation in the individual values.

The first analysis conducted was a logratio analysis (LRA) delineated by groups of coins associated with mints. Groups with either one or a few coins were not included because the low sample size would affect the statistical analyses: that is, coins from the mints attributed to Asia (that is, Asia Minor) (7), Carthage (1), Gaul or Spain (3), Judaea (3), Lycia (1), Numidia (1), Pergamon/Ephesus? (6), Seleucia (2), Syria (4) and Tarsus (2) were removed from the analyses.

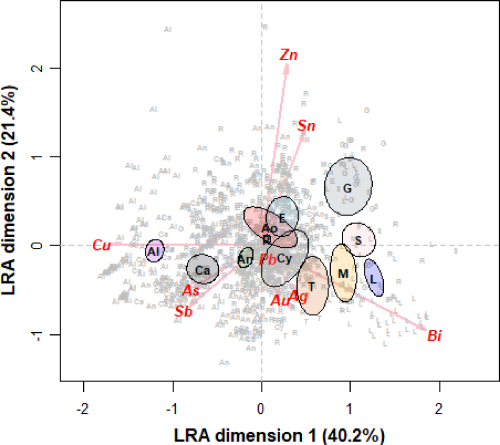

The 1023 coins from the following mints (abbreviated name and number of coins) that remain were used in the analyses: Alexandria (Al: 103), Antioch (An: 144), Antony (that is, the legionary denarii) (Ao: 11), Caesarea (Ca: 38), Cyprus (Cy:10), Ephesus (E: 20), Gaul (G: 19), Lyon (L: 60), Spanish (S: 20), Tyre (T: 9), Mauretania (M: 12), Rome (R: 577). Figure 9 is a plot from the logratio analysis (LRA) for 1023 coins from these 12 mints.

The LRA ratios in Figure 9 account for 61.6% of the total variance. The compositional ellipses of the mean values for each group reflect these variances and the number of samples in each group. As a rule of thumb, if two confidence ellipses do not overlap, then there will be a significant difference between the representative groups (Krzywinski and Altman 2013).

It can be seen that many of the groups in Figure 9 appear to separate along LRA dimension 1. A cursory inspection shows that mints associated with the West lie together; that is, those mints on the right of the plot (i.e. Gaul, Spain, Lyon and Mauretania). Coins associated with mints from the East (i.e. Alexandria, Caesarea, Antioch) lie on the left. Rome appears to lie in the middle, which may indicate that the Roman mint produced coins using metals that supplied the regions associated with both the western and eastern mints and/or mixing. There are overlaps among the ellipses associated with the mints of Rome, Ephesus and Cyprus, and for coins associated with Antony's campaign.

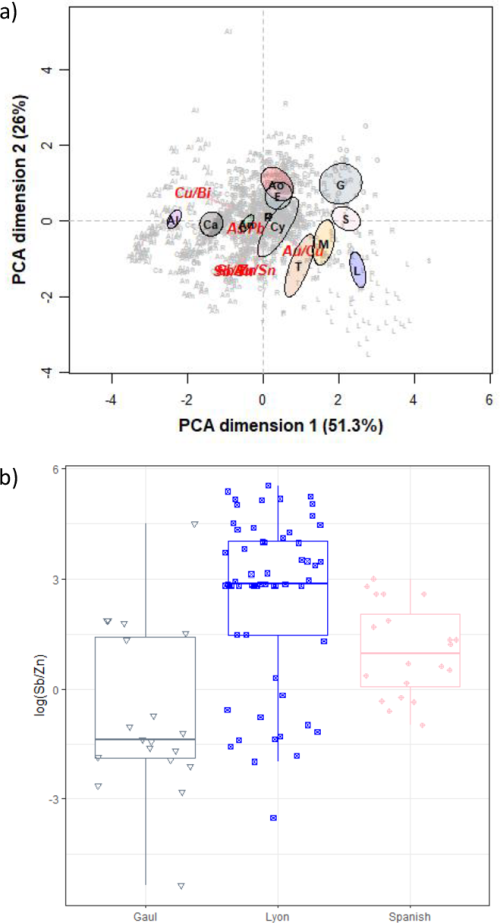

Although the LRA plot in Figure 9 represents the analysis of all pairwise logratios (numbering 36 combinations), a smaller set can be determined, which explains most of the variance while approximating closely the geometric structure of the compositional data. To examine the drivers for the compositional variation, a PCA was constructed (Figure 10a) using the method devised by Greenacre (2018) that uses a stepwise selection of a small set of simple pair-wise logratios to explain essentially all the variance in the total set of logratios. Although this selection can be enhanced by expert knowledge (Greenacre 2019; Wood and Greenacre 2021), the method adopted here was to select the ratios that explained the most variance as it was unknown a priori which components were responsible for the groups.

Six logratios identified from the stepwise procedure (that is, the automated procedure produced a list of candidate ratios in descending order of explained variance and the top logratio were selected at each stage and forced in, before the same stepwise procedure was performed on all of the remaining ratios) explained 94.1% of the variance of the dataset (cumulative variance of logratios: Cu/Bi (38.3%); Sb/Zn (57.8%); Au/Sn (70.9%); Au/Cu (81.3%); Sb/Sn (89.5%) and As/Pb (94.1%)).

Figure 10a plots the PCA using the six logratios. Since 77.3% of the variance is explained by the two dimensions, this means that 0.773 × 94.1 = 72.7% of the total logratio variance is explained by this two-dimensional solution.

As with the LRA plot, the mints appear to separate along dimension 1, with the logratios of Cu/Bi and Au/Cu potentially differentiating between many of the mints. This is perhaps not so surprising – as mentioned above, bismuth and gold can survive the cupellation process and copper was used to debase coinage. These indicators have also been shown to be useful for analysing Roman silver coinage elsewhere (Butcher and Ponting 2015). These two logratios are plotted in Figure 11. However, the PCA in Figure 10a also shows that mints separate along dimension 2. For example, coins from the Gaul, Spanish and Lyon mints exhibit differences in the logratio of (Sb/Zn) (Figure 10b). Since these coins are of high purity, the differences perhaps reflect different types of lead used in refining (i.e. lead with different levels of zinc and antimony) rather than impurities entering the system owing to the addition of copper (see Butcher and Ponting 2015, 285-87, for the application of zinc as a discriminator of silver fineness). Although the majority of coins minted at Lyon have high log(Sb/Zn) values, some coins minted in Lyon may have been refined from the same lead sources that were used at the Spanish and Gaul mints.

On first inspection, Figure 11 appears to be a debasement plot, as both logratios include the levels of copper in the coins, and clearly varying levels of copper reflect the varying levels of silver in the coins. However, this would be an oversimplification, as it is the variability of the logratios of (Au/Cu) and (Cu/Bi) that provide the rationale behind the plot. Coins from the Alexandria mint, for example, have low values of log(Au/Cu) and high values of log(Cu/Bi). This may suggest either that copper levels are higher and/or bismuth levels are lower in these coins relative to the other coins, and that gold levels are lower and/or copper levels are higher than the other coins. In effect, the values of the ratios reflect the variation in three components (Cu, Bi and Au) that represent a high proportion of variance of the total system. This can be used to identify groups of coins for further investigation (namely, through examination of the raw data).

Figure 11 exhibits clusters that are particularly evident for coins minted at Rome and at the mint of Alexandria. These clusters form because they have similar compositions, as determined from the multivariate analysis. Coins associated with the Rome mint appear to form three distinct groups in the centre of the plot, with two groups having similar values for log(Cu/Bi) but different values of log(Au/Cu). There are also clusters from the East mints (such as the Antioch mint) that lie within two of the Rome clusters, that is, the clusters with lower levels of log(Au/Cu). Figure 11 also shows that some coins minted at Lyon and unknown Gallic mints (log(Cu/Bi) ≈ 4 log(Au/Cu) ≈ -2) have similar values, which may well indicate that the same silver (that is, refined silver), perhaps unsurprisingly, was used at these mints. This is consistent with Figure 10b. Interestingly, the majority of coins minted at Tyre lie close to those minted in the West, thereby suggesting that this mint procured silver from the West that was not subject to further refining.

Figure 12a shows log(Cu/Bi) vs log(Au/Cu) for the coin data for the three geographical regions - East, Rome and West. For this plot, mints with only a few coins could be also included; that is, from the initial 1076 coins, 1052 were delineated by the three regions, East (360), Rome (577) and West (115). The single coin from Carthage was not included because it did not fit with these nominal groups.

To examine this plot in more detail, the smoothscatter package in R was applied to produce a density representation of the scatterplot, obtained through a (2D) kernel density estimate. The density was determined using the bkde2D function which computes a 2D binned kernel density estimate. Four probability densities were defined (from low to high): 0.7 (green), 0.5 (yellow), 0.25 (orange) and 0.1 (red).

Figure 12b shows the smoothscatter plot with contours designating three areas of highest density for the mints in the East group and three areas for the Roman mint (Figure 12c). Only one main high-density area formed for the coins from the West (Figure 12d), although a second delimited region has almost emerged. Two areas of high density were selected by eye within West Group1: West sub-group (upper) and West sub-group (lower).

Coins were extracted from the regions of the smoothscatter plots based on their densities. For example, for the 577 coins from the Rome mint, 190 coins lie within the 0.25 contours for the Roman coins (i.e. the probability level was selected because it enclosed coins in the three Roman groups): 51 coins lie within Rome Group 1, 119 within Rome Group 2 and 20 coins within Rome Group 3.

Table 1 shows the values of the logratios of (Cu/Bi) and (Au/Cu) for the coins extracted from the groups in each region alongside the mints and emperors associated with the coins. For instance, the 64 coins from the East within East Group 1 are all from the mint of Alexandria and contain coins associated with eleven emperors/rulers.

| Compositional groups | GROUP 1 | GROUP 2 | GROUP 3 | ||||

|---|---|---|---|---|---|---|---|

| log(Cu/Bi) | log(Au/Cu) | log(Cu/Bi) | log(Au/Cu) | log(Cu/Bi) | log(Au/Cu) | ||

| EAST | mean | 11.92 | - 6.47 | 10.12 | - 4.00 | 6.84 | - 4.20 |

| st.dev. | 0.49 | 0.26 | 0.25 | 0.13 | 0.75 | 0.35 | |

| median | 11.83 | - 6.48 | 10.13 | - 4.00 | 6.87 | - 4.17 | |

| No. coins | 64 | 10 | 147 | ||||

| Mints | Alexandria (64) | Antioch (2), Antony (2) Caesarea (6) | Antioch (105), Antony (8), Asia (2), Caesarea (9), Cyprus (6), Ephesus (8), Pergamon/Ephesus? (6), Seleucia (2), Syria (1) | ||||

| Emperors | Claudius (4), Cleopatra (2), Domitian (3), Galba (5), Nero (20), Nerva (4), Otho (4), Tiberius (4), Titus (4), Vespasian (12), Vitellius (2) | Antony (2), Caligula (2), Nero (3), Nero + Divus Claudius (1), Tiberius (1), Tiberius/Drusus (1) | Antony (9), Augustus (8), Caligula (3), Claudius (7), Claudius/Agrippina (1), Domitian (7), Galba (2), Nero (34), Nero + Divus Claudius (3), Nerva (2), Otho (4), Philip (1), Posthumous Philip (10), Vespasian (56) | ||||

| ROME | mean | 9.95 | - 3.61 | 6.93 | - 3.92 | 6.33 | - 2.72 |

| st.dev. | 0.23 | 0.11 | 0.44 | 0.24 | 0.23 | 0.08 | |

| median | 9.93 | - 3.58 | 6.94 | - 3.95 | 6.34 | - 2.73 | |

| No. coins | 51 | 119 | 20 | ||||

| Mints | Rome (51) | Rome (119) | Rome (20) | ||||

| Emperors | Domitian (1), Nero (1) Titus (3), Vespasian (37), Vitellius (9) | Domitian (11), Nero (7), Nerva (6), Titus (24), Vespasian (68), Vitellius (3) | Domitian (5), Galba (2), Nero (3), Nerva (4), Otho (3), Titus (1), Vespasian (1), Vitellius (1) | ||||

| WEST | mean | 3.86 | - 1.85 | West sub-group (upper) | West sub-group (lower) | ||

| 4.19 | -2.18 | 3.07 | - 1.35 | ||||

| st.dev. | 0.61 | 0.48 | 0.20 | 0.18 | 0.25 | 0.24 | |

| median | 4.03 | - 1.92 | 4.20 | - 2.21 | 3.10 | - 1.32 | |

| No. coins | 47 | 22 | 15 | ||||

| Mints | Gaul (12), Gaul or Spain (3), Lyon (12), Mauretania (12), Numidia (1), Spanish (12) | Gaul (8), Lyon (11), Numidia (1), Spanish (2) | Gaul (1), Lyon (1), Mauretania (6), Spanish (7) | ||||

| Emperors | Civil War (10), Galba (15), Juba I (1), Juba II (3), Juba II and Cleo. (3), Ptolemy (1), Vespasian (1). Vitellius (13) | Civil War (5), Galba (6), Ptolemy (1), Vitellius (10) | Galba (6), Juba I (1), Juba II (2), Juba II and Cleo. (3), Vitellius (3) | ||||

The mean, standard deviation and median values of the elemental compositions and Pb crustal ages (determined from the LIA), as well as the log(Au/Ag) and log(Bi/Pb) values for the coins within each of the groups that emerged from the statistical analysis are presented in Table 2.

The coins in these identified compositional groups can now be investigated to determine whether they have any archaeological or historical significance.

| Compositional Groups | As | Au | Cu | Pb | Sb | Sn | Zn | Bi | Ag | log(Au/Ag) | log(Bi/Pb) | Pb age (Ma) | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EAST | 1 n=64 | mean | 0.05795 | 0.12798 | 80.36104 | 0.21040 | 0.04741 | 0.01242 | 0.00096 | 0.00059 | 19.35190 | -5.03303 | -5.79249 | (NLIA=0) - |

| st.dev. | 0.02783 | 0.03015 | 3.52083 | 0.16698 | 0.02756 | 0.04176 | 0.00214 | 0.00028 | 3.58147 | 0.28156 | 0.72240 | - | ||

| median | 0.05274 | 0.12626 | 80.87842 | 0.15344 | 0.04033 | 0.00108 | 0.00029 | 0.00059 | 18.89140 | -4.99812 | -5.66053 | - | ||

| 2 n=10 | mean | 0.01425 | 0.45708 | 25.20604 | 0.28233 | 0.02520 | 0.01773 | 0.00058 | 0.00100 | 74.04391 | -5.10174 | -5.53221 | (NLIA=3) 245 | |

| st.dev. | 0.00901 | 0.08494 | 4.79356 | 0.17118 | 0.02799 | 0.02689 | 0.00050 | 0.00015 | 4.74882 | 0.24345 | 0.45079 | 107 | ||

| median | 0.01271 | 0.47427 | 26.94938 | 0.21300 | 0.01152 | 0.00264 | 0.00051 | 0.00104 | 72.26733 | -.98663 | -5.40695 | 246 | ||

| 3 n=147 | mean | 0.02571 | 0.42641 | 28.56643 | 0.60030 | 0.01791 | 0.05382 | 0.00237 | 0.03519 | 70.37809 | -5.13482 | -2.81754 | (NLIA=33) 216 | |

| st.dev. | 0.02027 | 0.11090 | 7.49661 | 0.39370 | 0.01020 | 0.12377 | 0.00487 | 0.02087 | 7.51821 | 0.30236 | 0.73096 | 78 | ||

| median | 0.02106 | 0.43523 | 28.81286 | 0.45824 | 0.01618 | 0.01281 | 0.00071 | 0.02861 | 70.08650 | -5.06400 | -2.72939 | 237 | ||

| ROME | 1 n=51 | mean | 0.01091 | 0.60259 | 22.19038 | 0.46750 | 0.00847 | 0.00426 | 0.00228 | 0.00108 | 76.69457 | -4.85152 | -5.98968 | (NLIA=7) 291 |

| st.dev. | 0.00546 | 0.06140 | 1.70900 | 0.24994 | 0.00427 | 0.00434 | 0.00488 | 0.00023 | 1.68511 | 0.11637 | 0.46020 | 13 | ||

| median | 0.00972 | 0.60550 | 21.98350 | 0.38781 | 0.00918 | 0.00294 | 0.00068 | 0.00105 | 76.94476 | -4.83595 | -5.94216 | 295 | ||

| 2 n=119 | mean | 0.01040 | 0.42513 | 21.15749 | 0.60213 | 0.01043 | 0.00930 | 0.00692 | 0.02261 | 77.80711 | -5.24253 | -3.29504 | (NLIA=7) 314 | |

| st.dev. | 0.00628 | 0.10261 | 3.74337 | 0.27395 | 0.00614 | 0.01281 | 0.02384 | 0.01056 | 3.83509 | 0.30547 | 0.62860 | 28 | ||

| median | 0.00915 | 0.41101 | 22.04684 | 0.54174 | 0.01010 | 0.00415 | 0.00170 | 0.0279 | 76.97301 | -5.23892 | -3.32036 | 309 | ||

| 3 n=20 | mean | 0.00806 | 0.54788 | 8.34634 | 0.65000 | 0.00876 | 0.01065 | 0.00196 | 0.01516 | 90.41482 | -5.12159 | -3.70837 | (NLIA=5) 271 | |

| st.dev. | 0.00341 | 0.09664 | 1.67538 | 0.25678 | 0.00731 | 0.01809 | 0.00511 | 0.00421 | 1.96451 | 0.20552 | 0.43009 | 24 | ||

| median | 0.00753 | 0.55416 | 7.87876 | 0.60328 | 0.00556 | 0.00381 | 0.00077 | 0.01539 | 90.94953 | -5.09933 | -3.76440 | 271 | ||

| WEST | 1 n=47 | mean | 0.01054 | 0.51846 | 3.33714 | 0.37271 | 0.00558 | 0.03321 | 0.01308 | 0.08178 | 95.66635 | -5.44062 | -1.74674 | (NLIA=25) 295 |

| st.dev. | 0.01701 | 0.39985 | 1.93764 | 0.19795 | 0.01359 | 0.03977 | 0.02329 | 0.08550 | 2.26791 | 0.71442 | 1.01421 | 50 | ||

| median | 0.00602 | 0.40504 | 3.52730 | 0.36762 | 0.00324 | 0.02012 | 0.00541 | 0.05634 | 95.73839 | 0.71442 | -1.92756 | 288 | ||

| sub1 (up) n=22 | mean | 0.01533 | 0.40590 | 3.60883 | 0.35539 | 0.00773 | 0.04016 | 0.02200 | 0.05469 | 95.56056 | -5.50038 | -1.87774 | (NLIA=20)287 | |

| st.dev. | 0.02409 | 0.09816 | 0.90515 | 0.08644 | 0.01977 | 0.02432 | 0.03035 | 0.01419 | 1.07255 | 0.32585 | 0.23780 | 8 | ||

| median | 0.00631 | 0.40782 | 3.69612 | 0.37275 | 0.00314 | 0.04195 | 0.01272 | 0.05640 | 95.32262 | -5.45961 | -1.92977 | 288 | ||

| sub1 (lw) n=15 | mean | 0.00658 | 0.70336 | 2.93039 | 0.36691 | 0.00385 | 0.03257 | 0.00252 | 0.14719 | 95.78362 | -5.12328 | -1.10555 | (NLIA=5) 356 | |

| st.dev. | 0.00230 | 0.47261 | 2.37405 | 0.22671 | 0.00230 | 0.06131 | 0.00527 | 0.12540 | 2.78948 | 0.69379 | 1.36454 | 62 | ||

| median | 0.00614 | 0.48595 | 1.67238 | 0.32876 | 0.00332 | 0.00642 | 0.00913 | 0.09128 | 97.20569 | -5.29973 | -1.57230 | 391 | ||

The clusters identified in Figure 11 and Figure 12 indicate that there were three main compositions of coinage from the Rome mint, three from the East and one (or potentially several smaller groups) from the West. These clusters could suggest mints produced unique compositions of coins at different times (Tables 3 and 4). For instance, comparison of Rome Groups 1-3 shows that not only do these groups have different levels of debasement (especially between Rome Group 3 and Rome Groups 1 and 2) but also different log(Bi/Pb) values and Pb crustal ages, thereby suggesting that lead derived from different sources or supplies. Since there is only archaeological evidence for one mint at Rome for the period under investigation (Jones 2015), this would suggest that the three compositions were made at the Rome mint during the periods with the associated rulers (Table 1). However, there may have been more than one location in Rome supplying the mint with blanks (Woytek 2020, 128-35).

By the same rationale, the clusters for the East and West groups potentially reflect differences in the compositional recipes produced at the mints over the periods associated with each of the emperors (Table 1). The West group may have groups within the main cluster (West 1). It is difficult to make any conclusions based on these subgroups (West subgroup 1 - upper and West subgroup 1 - lower) because they were not directly delimited by the kernel density estimate analysis; that is, subgroups were made by eye. Nonetheless, West subgroup 1 (lower) appears to be driven by the coins attributed to Mauretania, with their higher Au/Ag and log(Bi/Pb) ratios, differentiating it from West subgroup 1 (higher) .

Figure 12, Table 1 and Table 2 highlight overlaps between the cluster of coins that make up East Group 2 (log(Cu/Bi)=10.12, log(Au/Cu) = -4.00) and those of Rome Group 1 (log(Cu/Bi)=9.95, log(Au/Cu)=-3.61). Similarly, the coins that cluster within East Group 3 (log(Cu/Bi)=6.84, log(Au/Cu) = -4.20) overlap with the cluster of Rome Group 2 (log(Cu/Bi)=6.93, log(Au/Cu) = -3.92). It should be noted that Rome Group 3 appears to be distinct from the coins of the East (only two coins minted in Cyprus lie within Rome Group 3) and from the West (no coins from the West lie within Rome Group 3, or within the other Rome groups). This does not imply that the metals used to mint coins in the West were not used at Rome or at the mints in the East, but rather that these coins have different levels of debasement and so forth.

Examining East Group 3 and Rome Group 2 shows that, despite a degree of overlap in Figure 12, they exhibit differences in their compositions (Table 3). For example, the lead supply appears to be different in terms of both its log(Bi/Pb) ratio and its Pb crustal age; that is, East Group 3 appears to have used more bismuth-rich lead with lower crustal ages in its refining processes compared to Rome Group 2. In other words, overlaps are potentially a consequence of silver deriving from the same source (that is, these groups have similar Au/Cu values, which reflects their similar Au/Ag values, as increases in the copper levels will result in decreases in their silver concentrations) and similar levels of debasement. However, the log(Bi/Pb) indicates that at least some of the coins in these clusters were refined from different supplies of lead (i.e. with different levels of bismuth in the lead). Similarly, East Group 2 and Rome Group 1 have different logratios of (Bi/Pb) ratios and Pb crustal ages. Examination of the histograms in Figure 13 for the East and Rome groups highlight that although the majority of coins in East Group 3 and Rome Group 2, and East Group 2 and Rome Group 1 have similar values for the logratio of (Bi/Pb) there are also differences in the distributions. These differences would be consistent with the premise that silver was diluted with copper to prescribed levels but that silversmiths at different mints had access to different lead supplies to refine the procured silver ingots.

| As | Au | Cu | Pb | Sb | Sn | Zn | Bi | Ag | log(Au/Ag) | log(Bi/Pb) | Pb age (Ma) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| East Group 3 | 0.02571 | 0.42641 | 28.56643 | 0.60030 | 0.01791 | 0.05382 | 0.00237 | 0.03519 | 70.37809 | -5.13482 | -2.81754 | (NLIA=33) 216 |

| Rome Group 2 | 0.01040 | 0.42513 | 21.15749 | 0.60213 | 0.01043 | 0.00930 | 0.00692 | 0.02261 | 77.80711 | -5.24253 | -3.29504 | (NLIA=7) 314 |

| As | Au | Cu | Pb | Sb | Sn | Zn | Bi | Ag | log(Au/Ag) | log(Bi/Pb) | Pb age (Ma) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| East Group 2 | 0.01425 | 0.45708 | 25.20604 | 0.28233 | 0.02520 | 0.01773 | 0.00058 | 0.00100 | 74.04391 | -5.10174 | -5.53221 | (NLIA=3) 245 |

| Rome Group 1 | 0.01091 | 0.60259 | 22.19038 | 0.46750 | 0.00847 | 0.00426 | 0.00228 | 0.00108 | 76.69457 | -4.85152 | -5.98968 | (NLIA=7) 291 |

Regarding East Group 1, the low gold concentrations could suggest that coins produced at Alexandria were minted using silver from a source different from the other coins in the dataset. However, closer inspection indicates that the coins minted at Alexandria have lower absolute concentrations of gold because of dilution with copper, rather than deriving from a different silver source. Table 4 shows that if the coins from Rome Group 1 were melted down and debased with copper in a 1:3 ratio, the calculated composition of the dilution would be very similar to that of the coins minted in Alexandria in East Group 1.

| As | Au | Cu | Pb | Sb | Sn | Zn | Bi | Ag | log(Au/Ag) | log(Bi/Pb) | Pb age (Ma) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| East Group 1 (Alexandria) | 0.05795 | 0.12798 | 80.36104 | 0.21040 | 0.04741 | 0.01242 | 0.00096 | 0.00059 | 19.35190 | -5.03303 | -5.79249 | (NLIA=0) |

| Rome Group 1 | 0.01091 | 0.60259 | 22.19038 | 0.46750 | 0.00847 | 0.00426 | 0.00228 | 0.00108 | 76.69457 | -4.85152 | -5.98968 | (NLIA=7) 291 |

| Diluted Rome Group 1 (1:3 silver to copper) | 0.00273 | 0.15065 | 80.54760 | 0.11688 | 0.00212 | 0.00107 | 0.00057 | 0.00027 | 19.17364 |

This dilution could suggest that the tetradrachms minted at the Alexandria mint were produced by melting down and debasing denarii that had been minted at Rome. In fact, the higher antimony, arsenic, tin and zinc values in the Alexandria coins (compared to the calculated dilution, based on the addition of pure copper) could suggest that the Alexandria mint used bronze and brass coins in this debasement and/or recycled domestic copper-alloy wares; that is, from a copper ore such as a fahlore (a solid solution of tetrahedrite Cu12Sb4S13 and tennantite Cu12As4S13). This direct recycling scenario is supported by the similar log(Bi/Pb) values for East Group 1 (-5.79249) and Rome Group 1 (-5.98968); that is, the lead used in the refining process appears to be similar between the two groups. This implies that lead was not added, at least not at the Alexandria mint, during debasement (unless the lead added was from the same supply as that used at the Rome mint, which is unlikely), thereby suggesting that the similarity in the values of log(Bi/Pb) is because Roman denarii were melted down to produce tetradrachms at Alexandria (Butcher and Ponting 2015, 660). Furthermore, this recycling scenario would appear to be sensible from a historical perspective – the denarii in Rome Group 1 (Table 1) were produced during the period that the Alexandria mint was in operation.

Figure 13 presents histograms of Au/Ag × 100, log(Bi/Pb) and the Pb crustal ages (Ma) for the coins clustering in the multivariate analyses.

First, it must be noted that the Pb crustal age indicator cannot identify a specific lead deposit, as many lead deposits may have similar crustal ages and overlapping LIA signatures (see Figure 2 and Figure 3). Similarly, the range of the Au/Ag ratios can be wide in a silver-bearing deposit. Nonetheless, the range of values of the Au/Ag ratios are similar for the East and Rome groups and the main peak in the West Group. This could suggest that the majority of coins derived from the same silver source, potentially from south-west Iberia (although, as mentioned previously, this hypothesis is based solely on one parameter, that is, the Au/Ag ratio).

The Bi/Pb ratio for the East and Rome groups in Figure 13 appear to be bimodal. The higher peaks (approx. log(Bi/Pb) >-5) are found in the East, West and Rome groups. This could suggest that lead from the same supply was used at these mints. Lower peaks (log(Bi/Pb)<-5) are present in the East and Rome groups, but not for the West Group. This could suggest that the West had access to and used lead with higher bismuth levels (such as lead ores found in Iberia) to refine its silver, but not lead with low bismuth levels. A readily available supply of high-bismuth lead in Iberia would negate the need to acquire lead from elsewhere, but does not rule-out this possibility.

Some of the identified groups in Figure 13 overlap: for example, East Group 2 has similar Bi/Pb levels to part of East Group 1. This would suggest that, irrespective of their different levels of debasement (Table 2: East Group 2 ≈ 74% Ag; East Group 1 ≈ 19% Ag), the silver used for the coins in East Group 2 was refined using the same lead supply as some of the coins in East Group 1; that is, lead used for coins minted at Antioch, Caesarea and for Antony's legionary denarii, was also used for the coins minted at Alexandria. Alternatively, and perhaps more probably, considering the dilution examined in Table 6, it suggests that the Alexandria mint remelted and debased existing coinage.

Similarly, Rome Group 3 overlaps with part of Rome Group 2 (Figure 13), particularly for coins with lower Bi/Pb ratios (that is, -5 <log (Bi/Pb) <-3). Again, this could suggest that the same lead source was used, or that the coins in Rome Group 3 (≈90% Ag) were melted down and debased to produce coins found in Rome Group 2 (≈78% Ag). The crustal ages of Rome Group 3 appear to overlap with part of Rome Group 2, which is consistent with the overlapping Bi/Pb ratios for these two groups. Since Rome Group 3 consists of coinage minted under Galba, Otho, and Vitellius, and Rome Group 2 does not have many coins from this chronological period (three Vitellius coins out of 119 coins), it is conceivable that the coins of the Civil War Emperors were melted down and debased to make coinage for the Flavian Emperors. Rome Group 1 has similar crustal ages to Rome Group 2 and 3, despite having differences in the Bi/Pb ratio. This is difficult to explain. However, it is feasible that the lead added might have had similar crustal ages, but different Bi/Pb ratios.

East Group 3 appears to have a wide range of log(Bi/Pb) values, which could suggest more than one peak, that is, more than one source of lead. The crustal ages of the lead determined from the LIA also appear to be bimodal for East Group 3, which would support the view that the lead in the coins in East Group 3 was derived from more than one source (note that there are no LIA measurements for the coins from East Group 1 and only three coins for East Group 2). As alluded to earlier (Figure 3), the lower Pb crustal ages are generally associated with earlier coinage. This wide range of log(Bi/Pb) values is therefore consistent with the large chronological range associated with this group (East Group 3) and the attested periods of currency reform (i.e. recycling) associated with some of the rulers during this time.

The West Group has a wide range of log(Bi/Pb) and crustal ages. There are six coins with significantly higher Au/Ag levels. These coins, with Au/Ag × 100 values of around 1.2-1.6 and 2.4, were minted in Mauretania and also exhibit the highest log(Bi/Pb) levels. This would suggest that the lead used at the Mauretania mint, if secondary refining was conducted there, was derived from a different lead source (presumably in North Africa) to the other coins found in the West, Rome and East clusters.

Levels of debasement cannot be used to differentiate between time periods because emperors/rulers are often associated with coins in multiple groups. Coins in Rome Groups 1 to 3, for instance, have similar associations with emperors/rulers, despite having different levels of debasement: Rome Group 3 (≈ 90%Ag) and Rome Groups 1 and 2 (≈ 77%Ag) (Table 1, Table 2). Furthermore, apart from the very high values for the coins of Mauretania in West Group 1, the Au/Ag ratio cannot differentiate between groups because values overlap between groups from the East, Rome and West regions; that is, they are not significantly different (Table 2 and Figure 13). However, the bimodality of the Bi/Pb ratios in Figure 13 may provide a suitable metric to investigate differences in the lead used in the refining process at the mints. In effect, although some identified groups have a wide range of log(Bi/Pb) values, suggesting there may be more than one lead source associated with each peak, the overall bimodality exhibited by the coins from both the Rome and East mints suggests, to a first approximation, that the lead applied during refining can be viewed as deriving from lead with either low or high concentrations of bismuth; that is, log(Bi/Pb) is either less than or greater than ≈ -5. This empirical value is now used to explore the coins in the whole dataset.

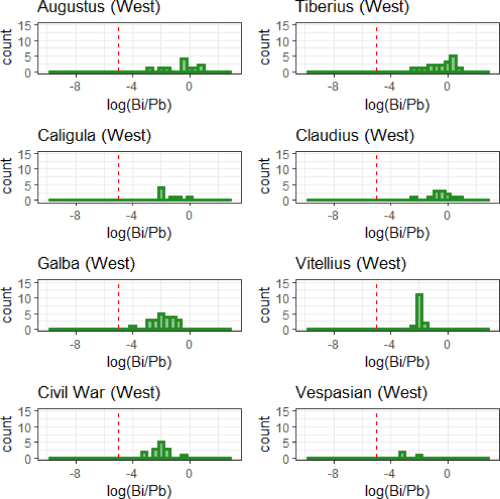

The histograms in Figure 14 are for silver denarii minted in the West for the emperors/rulers associated with these coins, delineated by the empirical value of log (Bi/Pb) = -5 (red dashed line). Each histogram has been plotted on the same scale for comparison purposes. These plots show that no coins minted in the West were refined using lead with low levels of bismuth (that is, log (Bi/Pb) <-5) over the time periods associated with these emperors/rulers. This suggests that bismuth-rich lead, potentially from Iberia, was used exclusively by the silversmiths at the West mints.

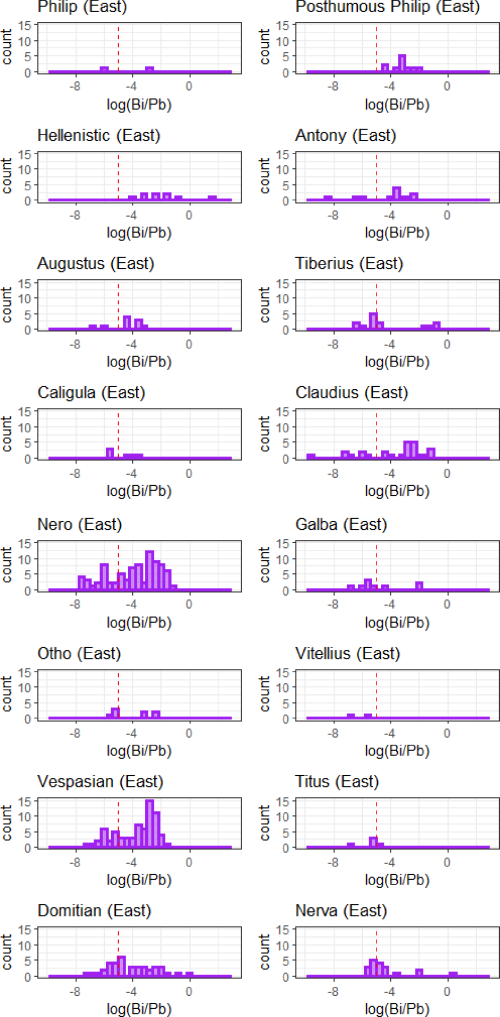

Conversely, the application of lead with low levels of bismuth was used by these same rulers to mint coinage in the East (Figure 15). Apart from eleven legionary denarii of Antony, these coins are all drachms, didrachms, tetradrachms or cistophorii. This low-bismuth signature appears to be well established by the reign of Nero. It should be further noted that between Nero and Vespasian, that is the Civil War of AD 69, there are not only fewer coins from the East mints (which, of course, is related to the number of these coins analysed) but there are also relatively fewer coins with high log (Bi/Pb) values, and none from the reign of Vitellius. This could suggest that access to high-bismuth lead was interrupted at this time. If this high-bismuth lead came from Iberia (that is, these coins have similar log(Bi/Pb) and crustal ages to those minted in Iberia), it could indicate that Iberian lead (and presumably Iberian silver) was not making its way to the mints of the East, and particularly to the Alexandrian mint that struck coins for Vitellius, in AD 69.

A further point of interest is that all nine coins from the Hellenistic period that were minted at Tyre, in addition to their high silver purity (Figure 4) and their grouping with coins minted in the West in the logratio plot (Figure 11), have log(Bi/Pb) values that are greater than -5, thereby supporting the view that they were refined in the West Mediterranean.

Furthermore, mixed signatures emerge, with logratios of (Bi/Pb) centred around -5. This could indicate that:

These mixed signatures in coins minted in the East appear to be common throughout the time of the Flavian emperors. Moreover, the coins minted under Nerva suggest an almost exclusive use of mixtures, which could indicate that silver coins were recycled from existing coinage for this emperor in the East mints.

At the Rome mint (Figure 16), mixed signatures appear common (i.e. log(Bi/Pb) ≈ -5), and are particularly evident for the coins minted under Vespasian. Again, these mixed signatures could suggest the mixing and melting down of existing coins to make new (and debased) coinage as well as the use of mixtures of lead used during refining. Any interruption to supplies associated with these high-bismuth lead signatures during the Civil War are less apparent at the Rome mint than at the mints of the East.

On first inspection, the branch of seven coins that appears to lie below the other LIA data in Figure 2 could suggest that some of these coins had been minted from coins that had been previously melted down together. For instance, the four coins from Nero, which are post-reform denarii and widely assumed to have been minted by recycling existing coinage (Butcher and Ponting 2015), lie very close to the two coins of Augustus and Tiberius. However, despite similar low 208Pb/204Pb values, it is inadvisable to assume that coins of Augustus and Tiberius minted at Lyon were recycled to produce coins for Nero minted at Rome, based solely on LIA. Furthermore, the coin from Otho, the second of the four emperors in AD 69, also lies close to these coins.

Table 5 presents the elemental and isotopic values for these coins. Even though the LIA are similar, and the differences in copper values could be explained by subsequent debasement of Nero's coins at Rome, the Au/Ag × 100 values of the coins from Augustus and Tiberius are different from the coins from Nero and their log (Bi/Pb) values are a much higher. This suggests that not only were the silver supplies of these coins different, but there were also differences in the lead supplies used in the refining processes.

| Ref. No. | MINT | EMPEROR | As | Au | Cu (%) | Pb | Sb | Sn | Zn | Bi | Ag (%) | log (Bi/Pb) | Au/Ag x 100 | 206Pb/204Pb | 207Pb/204Pb | 208Pb/204Pb | 207Pb/206Pb | 208Pb/206Pb | Pb crustal age (Ma) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BM3 | Rome | Nero | 76.2 | 6076.8 | 16.12 | 8682.7 | 66.2 | 13.5 | 20.1 | 113.0 | 82.37 | -4.34 | 0.74 | 18.372 | 15.609 | 38.335 | 0.850 | 2.087 | 244 |

| Don10 | Rome | Nero | 106.3 | 5432.2 | 8.75 | 8099.6 | 304.3 | 197.0 | 235.5 | 184.7 | 89.79 | -3.78 | 0.61 | 18.319 | 15.596 | 38.292 | 0.851 | 2.091 | 259 |

| Don3 | Rome | Nero | 46.8 | 5607.3 | 7.90 | 7256.3 | 84.1 | 7.3 | 1.2 | 179.4 | 90.77 | -3.70 | 0.62 | 18.376 | 15.607 | 38.288 | 0.850 | 2.083 | 237 |

| Don4 | Rome | Nero | 57.0 | 4521.5 | 8.13 | 10498.2 | 37.8 | 17.3 | 1.7 | 187.6 | 90.33 | -4.02 | 0.50 | 18.337 | 15.569 | 38.138 | 0.849 | 2.080 | 192 |

| M16 | Rome | Otho | 95.4 | 7891.6 | 5.58 | 7571.1 | 23.5 | 17.0 | 4.6 | 144.6 | 92.84 | -3.96 | 0.85 | 18.394 | 15.632 | 38.405 | 0.850 | 2.088 | 271 |

| Nor1 | Lyon | Augustus | 72.7 | 9823.0 | 0.12 | 316.9 | 74.4 | 16.3 | 1.6 | 64.4 | 98.84 | -1.59 | 0.99 | 18.343 | 15.579 | 38.247 | 0.849 | 2.086 | 207 |

| WM111 | Lyon | Tiberius | 81.0 | 3605.3 | 0.11 | 2582.2 | 36.7 | 16.1 | 1.6 | 1009.5 | 99.15 | -0.94 | 0.36 | 18.326 | 15.600 | 38.315 | 0.851 | 2.091 | 261 |

One question, however, is whether the introduction of low-bismuth lead can be related to historical events; that is, the introduction of low-bismuth lead into coinage from the late Hellenistic period or earlier (Figure 15).